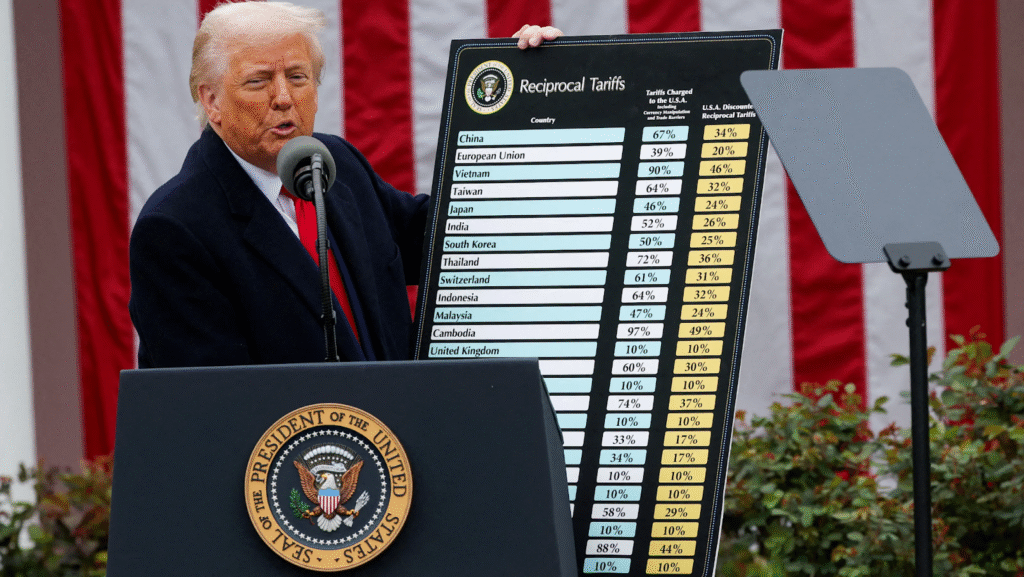

In 2025, the United States entered a new era of economic confrontation as Trump’s recent 100% tariffs on China officially took effect. Designed to protect American manufacturing and reduce dependence on Chinese imports, this sweeping policy has become one of the most debated trade moves in modern history.

These tariffs, implemented in September 2025, cover an enormous range of products from everyday electronics and vehicles to textiles, agricultural imports, and industrial machinery. While the White House frames this as a step toward “economic independence,” businesses, investors, and workers across the country are feeling both the opportunities and growing pains of this trade shift.

When the Tariffs Took Effect and What They Target

The 100% tariffs became active after months of escalating trade negotiations and were immediately applied to over $500 billion worth of Chinese imports. The U.S. government justified the move by citing China’s alleged unfair trade practices, cyber theft, and intellectual property violations.

The goods covered by these tariffs are vast, but several sectors stand out for their heavy exposure:

- Electronics: Smartphones, laptops, tablets, chips, and semiconductors.

- Automobiles and Electric Vehicles: Components like lithium batteries, motors, and sensors.

- Textiles and Apparel: Clothing, footwear, accessories, and synthetic fabrics.

- Industrial Equipment: Pumps, electric motors, generators, gearboxes, bearings, and sensors.

- Food Imports: Canned seafood, sauces, seasonings, and processed agricultural items.

The effect is widespread and almost every American household will feel some level of impact. From smartphone upgrades to car parts, consumers will soon pay more or wait longer for deliveries.

Projected Dollar Impact: How Much Will It Cost the U.S. Economy?

Analysts estimate the projected dollar amount of impact could range from $300 billion to $400 billion annually in increased import costs. The U.S. Chamber of Commerce predicts that consumer prices could rise between 5% and 12% in key categories like electronics, household goods, and automotive parts.

Businesses are responding by shifting supply chains toward Vietnam, India, and Mexico, but such realignments take time. In the interim, higher costs will ripple through manufacturers, retailers, and ultimately, consumers.

The states most affected include:

- California – Technology imports and semiconductor supply chains hit hardest.

- Michigan – Automobile production costs skyrocketing due to part shortages.

- Texas – Industrial machinery and oilfield equipment heavily reliant on Chinese suppliers.

- New York – Retail, textiles, and imported foods under price strain.

- Ohio & Illinois – Manufacturing hubs adapting to higher maintenance and equipment costs.

Together, these regions could see billions in cost inflation, but they also stand to gain from domestic reinvestment in repair, refitting, and fabrication services.

Repair Over Replacement: The New Industrial Mindset

With tariffs making imported parts costly and shipping times unpredictable, many companies and individuals are rethinking their approach: instead of replacing imported equipment, they’re repairing what they already own.

This shift is reviving America’s long-dormant repair economy. Workshops specializing in electric motors, pumps, gearboxes, and generators are seeing a surge in activity. For industrial sectors that rely on uptime such as energy, manufacturing, and agriculture, repairing rather than replacing is becoming both a cost-saving and time-saving strategy.

As one Midwestern repair facility owner put it, a gearbox that cost $2,000 to import from China now costs $4,000 and that’s if you can even get it shipped in time. Repairing it locally for half that cost just makes sense.

The labor demand for hard to find experienced equipment mechanics and certified generator technician professionals is skyrocketing. These skilled tradespeople, often overlooked in recent years, are now central to America’s ability to keep its factories, plants, farms, and fleets running.

This change doesn’t just affect industries, it also reshapes education and employment. Trade schools are seeing renewed interest in mechanical and electrical certification programs, signaling a long-term skills shift across the economy.

Jobs Lost and Careers Gaining Strength

While Trump’s 100% tariffs aim to strengthen domestic production, the transition period comes with significant turbulence. Economists predict that up to 250,000 U.S. jobs could be at risk particularly in import-heavy retail sectors, logistics, and factories dependent on Chinese raw materials.

However, as supply chains adjust, new opportunities are emerging:

- The repair and maintenance industries are booming.

- Skilled trades like machinists, electromechanics and certified generator technicians are in short supply.

- Domestic parts manufacturing is receiving fresh investment.

- Supply chain analysts and logistics experts are increasingly in demand.

- Automation and industrial maintenance professionals are securing higher pay and stability.

This reindustrialization through necessity is accelerating job creation in areas once thought to be in decline especially in the Midwest and South, where machine shops and repair centers are becoming vital again.

Stocks to Watch: Winners and Losers

The stock market’s response to the tariffs has been mixed, with some sectors suffering and others thriving. Investors are watching several categories closely:

Potential Winners:

- Domestic manufacturers like Caterpillar, Emerson Electric, and GE Vernova.

- Repair and parts suppliers such as Grainger and Motion Industries.

- Generator and backup power companies like Cummins and Generac.

- U.S.-based logistics firms including Union Pacific and FedEx, benefiting from reshoring efforts.

Potential Losers:

- Tech giants reliant on Chinese components, such as Apple and Tesla.

- Retailers dependent on imported goods, including Walmart and Target.

- Fashion and textile companies importing from Asia.

Investors are now turning toward reshoring stocks firms likely to gain from domestic reinvestment and local repair trends as a hedge against global trade volatility.

Can the Tariffs Change? What’s Next for U.S.–China Trade Policy

One of the biggest questions remains: can the tariffs be changed or rolled back?

While the current administration maintains that the tariffs are non-negotiable leverage, experts suggest several possible triggers for change:

- Diplomatic Negotiations: If China agrees to stricter intellectual property protections or trade balance reforms, the U.S. might ease certain categories of tariffs.

- Domestic Pressure: Rising consumer prices or industry lobbying could push the administration to revise or suspend parts of the policy.

- Legal and Congressional Challenges: Ongoing lawsuits from industry groups could result in partial relief or exemptions.

However, in the near term, the White House appears resolute. As Trump stated in a recent press briefing, We’re done building other nations’ factories. It’s time to rebuild our own.

That message suggests the tariffs while potentially adjustable in scope are here to stay for the foreseeable future.

Conclusion: America’s Turning Point

Trump’s 100% tariffs on China mark more than just a trade battle; they represent a profound economic pivot toward self-reliance. While consumers and importers will bear short-term pain through higher prices, the long-term effects may foster a stronger, more resilient U.S. industrial base.

Jobs in repair, maintenance, and electromechanical trades are making a comeback, and states hit hardest by globalization are finding new life in small repair shops, machine shops, and industrial service businesses.

Whether these tariffs remain permanent or evolve through future diplomacy, one thing is clear: America’s approach to trade and industry has changed forever. The new mantra isn’t just Buy American it’s Fix American.